The Prefect Financial Storm

The real estate market in 2007 and 2008 was devastated in the likes that we haven’t seen in many, many years. Market conditions have placed a huge burden upon lenders as they find themselves saddled with a massive inventory of non-performing loans(notes). Under normal circumstances, the lender will try to work the problem out directly with the borrower. If that proves unsuccessful, the lender then begins the foreclosure process in order to recover the collateral.

In today’s market, there are simply too many non-performing loans for the lenders to effectively resolve them relying on the same old processes. Lenders are not as adept at quickly adapting to market forces resulting in trillions of non-performing notes waiting for resolution and it is growing much faster than the lenders can handle.

In today’s market, there are simply too many non-performing loans for the lenders to effectively resolve them relying on the same old processes. Lenders are not as adept at quickly adapting to market forces resulting in trillions of non-performing notes waiting for resolution and it is growing much faster than the lenders can handle.

The growing trend for resolution is the direct sale of the non-performing note where the lender simply decides to let someone else deal with the problem. The bank realizes it has a wart on their balance sheet that is not only non-performing, but has not yet gone through the foreclosure process to wash out the liens and other clouds on the title that keep the property from re-structuring towards a performing asset again. Often, non-performing notes involve a lot of work and expense. Over the life to the process it could reach as high as $50,000/property. This is due in part to the high cost of foreclosure which typically can run has high as $25,000 not to mention the cost to manage the REO, possible fix up and other related selling costs Therefore, it is cheaper for the lender to sell the non-performing notes these “toxic” assets in pools to hedge funds. a discount to a buyer(hedge funds). This process allows the lender to quickly recover its capital without the time and expense of foreclosure and subsequent marketing and sale of the property.

Therefore, it is cheaper for the lender to sell the non-performing notes these “toxic” assets in pools to hedge funds. a discount to a buyer(hedge funds). This process allows the lender to quickly recover its capital without the time and expense of foreclosure and subsequent marketing and sale of the property.

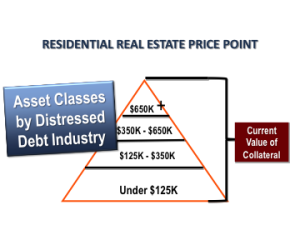

The hedge funds in turn will sell the notes as a one off to individual investors that are either interested in the note, or interested in acquiring the underlying collateral. The hedge funds will rent out or lease option the properties with values exceeding $125,000 for and hold them for 3 years.

However most of these notes are in the $125,000 range. Upon purchase, the note buyer “steps into the shoes” of the lender and assumes all rights and remedies that the lender had under the loan documents. This is accomplished primarily by the assignment to the borrower of the loan documents; including the note, the mortgage and security agreement and, if applicable, the guaranty.

H owever, while the buyer obtains all of the benefits held by the lender, it is equally important to remember that he also obtains all of the burdens. This includes the risk that the loan documentation history may be flawed, that the borrower may refuse to cooperate in either a modification or a foreclosure alternative and the risk that pursuing foreclosure may take much longer than expected. In other words, just like the lender, the borrower now holds a note that is not performing and which will require resolution

owever, while the buyer obtains all of the benefits held by the lender, it is equally important to remember that he also obtains all of the burdens. This includes the risk that the loan documentation history may be flawed, that the borrower may refuse to cooperate in either a modification or a foreclosure alternative and the risk that pursuing foreclosure may take much longer than expected. In other words, just like the lender, the borrower now holds a note that is not performing and which will require resolution

Non-performing notes are priced very aggressively because the bank has a wart on their balance sheet that is not only performing, but has not yet gone through the foreclosure process to wash out the liens and other clouds on the title that keep the property from re-structuring towards a performing asset again. Often, non-performing notes involve a lot of work and will have plenty of obstacles to over come once purchased, but the bank realizes this and prices the asset very aggressively to sell.

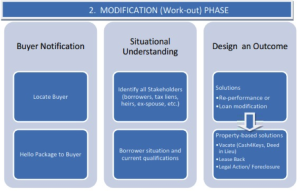

When buying a non-performing note, the buyer must determine:

- The buyer should conduct due diligence on the loan documents

- Identify all the Stakeholders

- The borrower’s financial condition.

- Are they open to a loan modification?

- Are they motivated and have the means to fight a foreclosure?

- Or will they file a bankruptcy to delay the process.

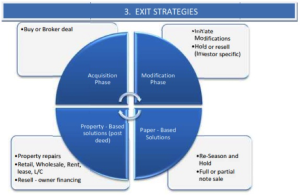

In addition to the above and like any other real estate investment, one must determine the appropriate exit strategy. In other words, just like the lender, the borrower now holds a note that is not performing and which will require resolution. Those options include following:

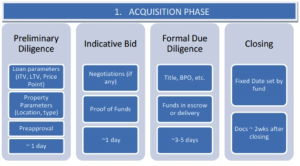

- Acquisition Phase–Buy or broker the deal

- Modification Phase

- Property Based Solution

- Paper Based Solutions

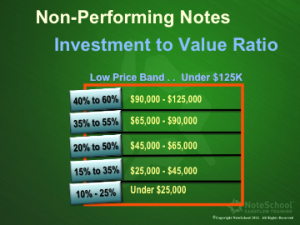

For many buyers, non-performing notes are attractive investments because they typically trade at a large discount off of the secured property’s perceived value. In fact, it is not uncommon to see non-performing notes trade at a discount of up to 80% or more off of the unpaid balance. It should be remembered, however, that this discount is a reflection of the note’s distressed condition and/or the condition of the asset.

Non-performing notes do have great investment potential. However, a buyer should not assume that a non-performing note is a guaranteed shortcut to acquiring the underlying asset. The prudent buyer will conduct thorough due diligence, not just on the underlying property, but upon the borrower, the lender and the status of the loan documents. The buyer must understand why the property is distressed and what additional expenditures in time and capital will be necessary to either bring the loan back to a performing condition, or to recover the underlying asset. When a buyer understands these issues, he will be more able to assess whether the discount being offered is sufficient enough to justify the risk.

Non-performing notes do have great investment potential. However, a buyer should not assume that a non-performing note is a guaranteed shortcut to acquiring the underlying asset. The prudent buyer will conduct thorough due diligence, not just on the underlying property, but upon the borrower, the lender and the status of the loan documents. The buyer must understand why the property is distressed and what additional expenditures in time and capital will be necessary to either bring the loan back to a performing condition, or to recover the underlying asset. When a buyer understands these issues, he will be more able to assess whether the discount being offered is sufficient enough to justify the risk.

Hardly any other asset can offer such aggressive pricing and strong rewards for investors. As the housing correction continues to take place for the next several years, more and more opportunities will be available for investors who are well positioned and willing to take on risk for big rewards. It is the perfect option to control real estate with an option and not have any of the downsides associated with property ownership for pennies on the dollar. An incredible once-in-a-lifetime market condition.